At the very core of finance sits the time value of money (TVM). Every decision about what something is worth begs the question, “worth when?” If in ten (10) years, then maybe the best course of action is to wait 10 years and find out. A lot can change in that amount of time. For example, the supply of your item could change, or the demand for your item could change, or the condition of your item could deteriorate, and the meaning of the word “dollar” will assuredly change. Even if all that could be constant, there is an opportunity cost to consummating the deal because all the other items in the world are surely not going to stay constant.

The best way to understand the time value of money (TVM), is to begin to think in terms of opportunity cost of capital. In other words, what kind of return on investment could you make or what kind of interest rate could you earn if you put your money someplace else? When you are borrowing money, your lender knows this. By extension, when you are borrowing anything of value (e.g., leasing a tractor), your vendor knows this. Like it or not, the transacted price of anything of value (assuming competent parties where one is not exploiting the other) incorporates the opportunity cost and time value of money. And just because the terms of the deal make that reality opaque (a lease, an early buy, a rent to own, promotional vendor financing, adjustable rate loan,…) – in fact, perhaps exactly because the terms of deals often make the time value of money reality opaque – , farmer beware. Milton Friedman’s TANSTAAFL ("There ain't no such thing as a free lunch") was taught in my 1979 Jr. High social studies class and perhaps is unfortunately emphasized less in today’s curriculums.

Since the reader is not likely transacting in a barter economy, think in dollar terms. If we assume US dollars, then the Federal Reserve banking system creates a minimum opportunity cost for each dollar – a floor if you will. The market for actual dollars in the public facing currency markets floats above this floor. Higher interest rates affect the value of everything.

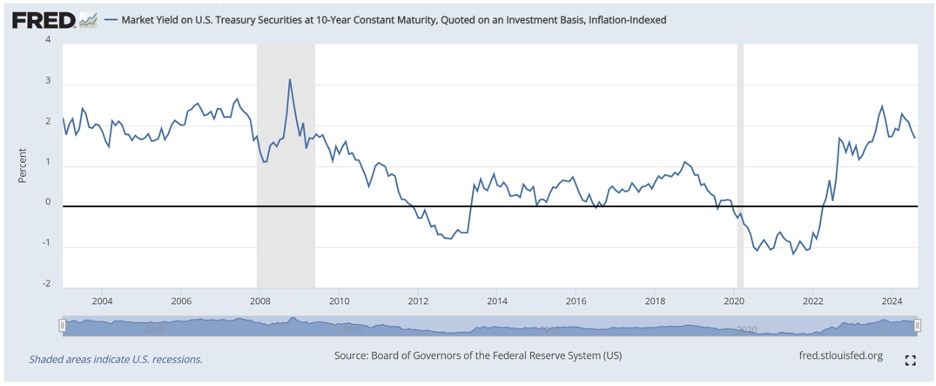

As markets attempt to judge and compensate for specific entity risk along with risk through time, finance terms for discrete transactions ultimately get negotiated. This is an uncertain science for all involved because real inflation can erode purchasing power of dollars invested in even the least risky of places as the following graph reminds us.

As you the farmer plan for the future, understand that the post-Covid world is a different environment than the dozen-plus years between the Financial Crisis of 2008 and now, both in terms of inflation and interest rates. Do not assume that what worked then will work now in terms of your level of capital expenditure, access to liquidity, acceptable leverage, and workability of variable rate financing terms.