“A budget is telling your money where to go instead of wondering where it went”—Dave Ramsey

What does a budget do for me?

A budget is a farm owner’s plan of action and evaluative tool for operational performance. Budgeting allows you to model the financial effect of varying yields, prices, input costs, expansion, and other economic factors. It helps your farm operation carefully control expenditures, preventing over- and unplanned spending.

What should my budget include?

A budget is a quantitative plan that identifies the resources needed to fulfill your operation’s goals and objectives. A good budget uses historical data as a base and reference and also incorporates anticipated cost and revenue variations based on current knowledge and an understanding of the internal and external factors that affect the farming operation.

Where should I start?

First, consider how the various aspects of your farming operation interrelate. For example, consider whether your crop plan is completed. If it is, use it to determine your labor and equipment needs for the coming year, and decide whether you anticipate any additional hires or new purchases. If so, determine whether you will borrow money to fund these costs.

Most importantly, be honest and realistic. Once it’s completed, enter your budget into your accounting system. Perform monthly budget analysis by producing a report that retains the original budget and compares it to the actual results to date, and manage any variances.

Budget Cycles and Measurements

Agriculture deals with two budget timelines: yearly income statement and cash flow budgets and a crop cycle managerial budget, which can span 18 months or more. The charts below illustrate the difference between a calendar year and a crop year budget.

12-Month Budgeted Income Statement

A budgeted income statement is a key part of the farm financial planning process, helping the operation determine if its plans are financially feasible. To create a budgeted income statement, replicate the line items in your previous income statements, but use it to anticipate the coming year rather than to report the previous year. Start by setting revenue goals, acres, and projected yields and prices. For expenses, look at previous year-end amounts by expense line item and then adjust according to any changes you anticipate.

Sample 1 is a 12-month income statement budget.

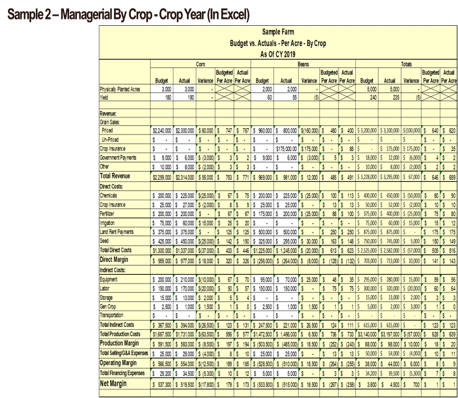

Managerial Crop Cycle Budget

A crop cycle managerial budget estimates income, costs, and profits associated with the production of each crop. This budget covers the life of the crop, so it can stretch over 18 months or more. The crop cycle managerial budget looks at three margin calculations:

-

Production margin (revenue less all production-related costs, excluding SG&A and financing)

-

Operating margin (revenue less all production-related expense, including SG&A but excluding financing)

-

Net margin (revenue less all production-related expenses, including SG&A and financing costs).

Sample 2 is a crop cycle managerial budget, organized by crop.

12-Month Cash Flow Budget

A cash budget (or cash flow forecast) shows cash going in and out of the business. It tells you whether you will need additional cash to carry out operations. It shouldn’t be complex; it requires detailing the cash receipts and cash expenses by month and in total for the year. Develop a cash flow budget to plan the timing of your cash flows and borrowing needs.

Sample 3 is a monthly cash flow budget.

A budget should help you ensure profitability and quantify the resources required to achieve your plans. Use your budgets to monitor results compared to what you had planned, and you’ll be able to budget more accurately in the future.

If you’d like help developing budgets for your farming operation, get in touch with the expert agricultural financial consultants at UnCommon Farms. Our ag-specific suite of financial consulting services can help you improve your farm’s financial performance this year and for years to come.