“Efficiency is doing things right. Effectiveness is doing the right thing.” – Zig Ziglar

Financial ratios measure your progress over time in order to make sure you're meeting your lender’s requirements and to benchmark yourself against your peers. Efficiency is getting more output from the same resources or getting the same output from fewer resources. There are ratios used to measure production efficiency, financial efficiency, or a combination of both. The operating expense ratio is one important measure to examine to determine how well a farming operation is using its income to generate revenue.

What is an operating expense ratio?

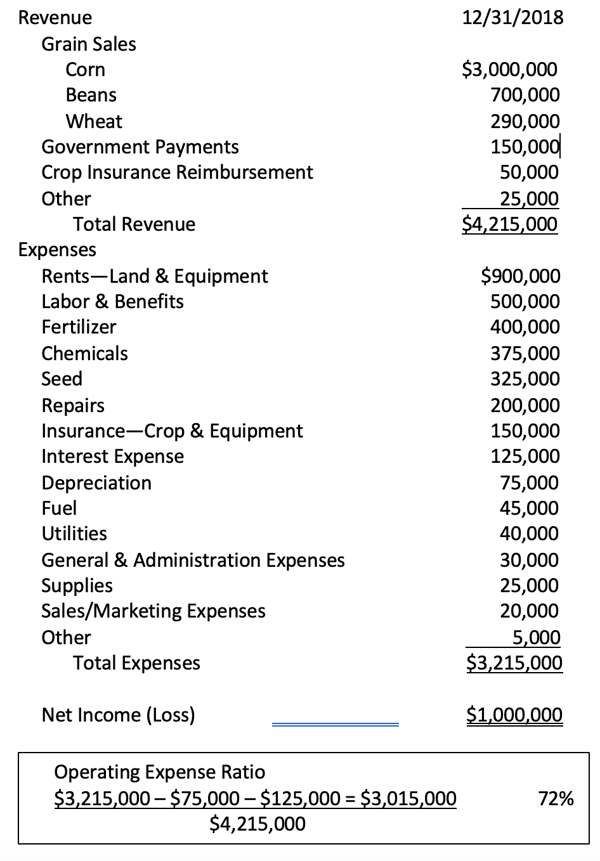

The Financial Guidelines for Agriculture outlined by the Farm Financial Standards Council define the operating expense ratio as “a measure of how gross farm income is used.” Calculated by dividing total operating expenses by gross revenues, this ratio indicates the proportion of a farm’s income that is used to pay cover operating expenses, excluding depreciation and interest.

Why is it important?

Operating expenses are the costs associated with running a company’s daily activities to produce its goods or services. Generally speaking, the lower the company’s operating costs are, the more profitable the company can be. In farming, the operating expense ratio indicates how efficiently crops are being produced.

As a measure of the amount of revenue being used to pay operational expenses, it can be utilized to identify potential expense problem areas and opportunities for cost savings. Your lender uses the operating expense ratio as a measure of your operation’s financial stability and to determine how much it will cost you to borrow requested funds while sustaining your farm’s operations. The higher the ratio, the more of each revenue dollar is being used to pay expenses. In agriculture, a healthy operating expense ratio is considered one that is less than 65%.

What if my operating expense ratio is higher than recommended?

If this ratio is higher than it should be, you can lower it by either increasing revenue at a relatively low cost or simply by reducing your costs. It’s important to be proactive with your expenses: look at each expense line item to determine whether you’re exceeding your budget and whether less expensive alternatives are available. Here are a few ways you can do this:

- Shop vendor prices

- Determine whether owning or renting/leasing equipment is more cost effective

- Cancel unused services

- Promote efficiency through technology

Here is an example for an operating expense ratio calculation:

For more detailed analysis and for benchmarking purposes, the operating expense ratio can be broken down into individual expense categories as a percent of gross revenues, e.g., chemicals, crop insurance, fertilizer, irrigation, land rents, seed, labor, equipment costs, etc.

The operating expense ratio is a valuable tool to help you improve your farm’s efficiency. Remember to set a budget for your operation. Then monitor how well you adhere to it, and get ahead of efficiency issues as soon as possible to and correct them swiftly and thoroughly.

UnCommon Farms provides expert financial consultation and training to help keep families on their farms. Check out our free ebooks and case studies to learn more about agricultural financial topics and how we’ve helped families like yours.